Applenews

Apple Beats Forecasts And Sets Services Revenue Record

Abdullah Mustapha

May 2, 2025

Apple has posted strong results for the second quarter of its fiscal year. Apple did better than expected by analysts and registered growth in most key areas. As per CEO Tim Cook, “Today Apple is reporting strong quarterly results, including double-digit growth in Services.”

Apple Reports Strong Q2 Results with All-Time High Services Revenue and $100 Billion Buyback

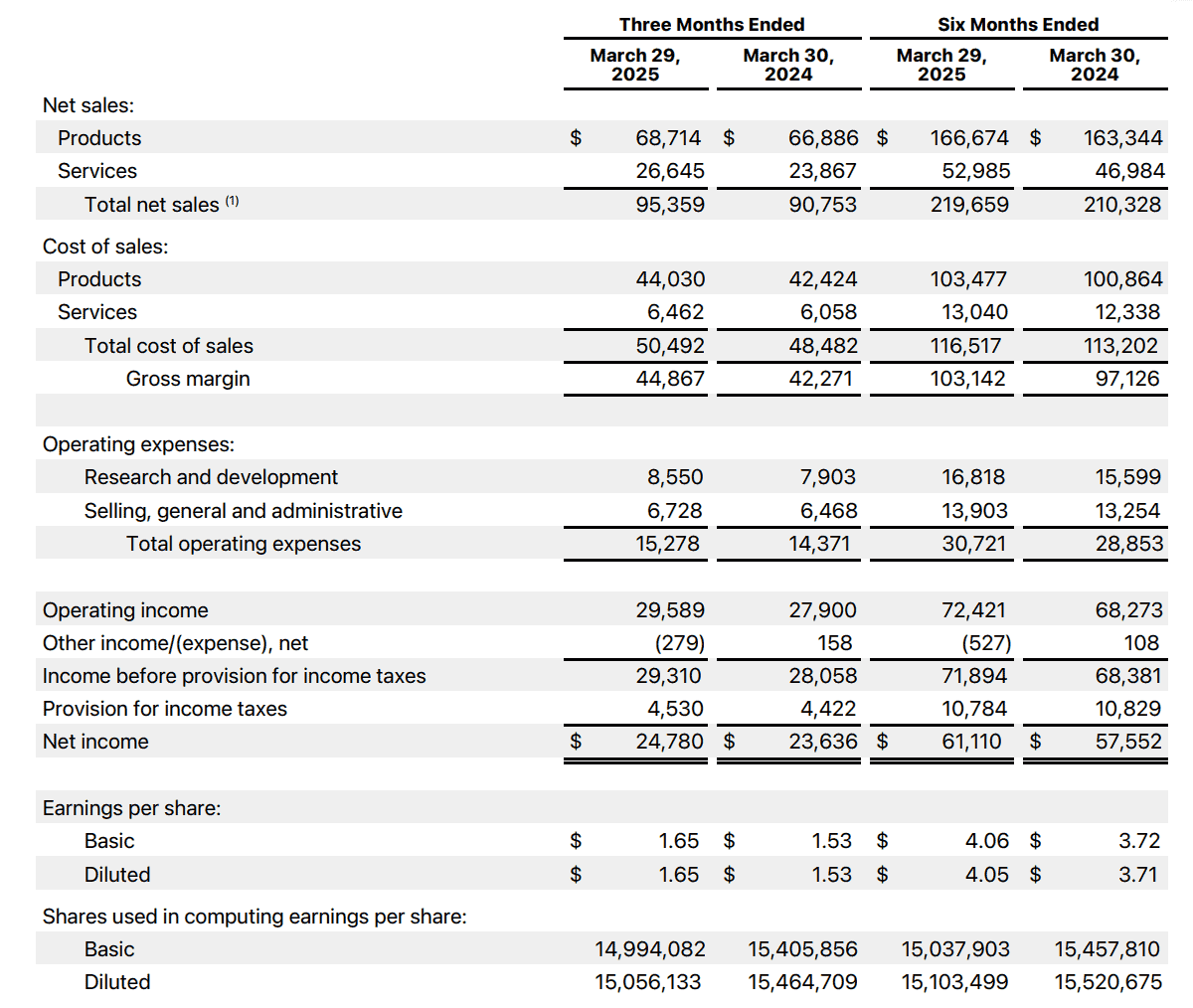

Quarterly sales through March were $95.4 billion. That exceeded the $94.6 billion analysts expected would happen and is a 5% increase from the same quarter last year. Earnings per share were $1.65, which is higher than the expected $1.62 and 8% more than last year.

Apple’s Services division made a ton of money this quarter. It earned $26.65 billion, up from $23.87 billion a year ago. That’s the App Store, Apple Music, iCloud, and other services. The growth could, though, slow down. Regulators have told Apple to make some rules changes for its app store, which might cut into the fees developers have to pay.

Apple Surpasses Expectations with Record Services Revenue and $100B Share Buyback

Apple’s top-selling item remains the iPhone. It generated $46.84 billion in revenue this quarter. Other items such as Macs, iPads, and wearables generated fewer funds and remained relatively constant compared to last year.

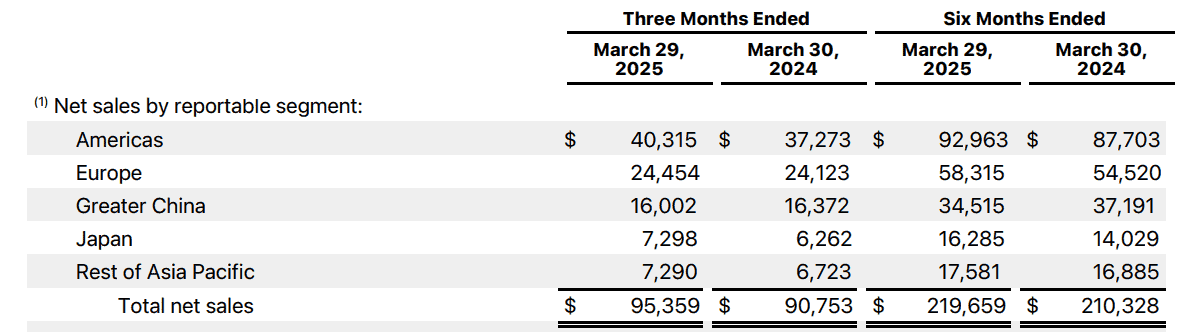

Apple observed an increase in the Americas, Japan, and Asia-Pacific. The sales in Europe and China stayed the same with no significant change. CFO Kevan Parekh spoke about the company’s strong finances. “Our March quarter performance delivered an 8 percent EPS growth and $24 billion of operating cash flow, which allowed us to return $29 billion to shareholders,” he stated.

Apple has also raised its dividend. It is now paying $0.26 a share, a 4% increase from last year. The dividend will be paid on May 15.

Also, Apple revealed a massive plan to repurchase its stock. The firm will repurchase as much as $100 billion in shares. This indicates that it believes in its long-term worth and aids its shareholders. The company continues to be one of the world’s top technology companies because of strong iPhone sales, all-time high services revenue, and a huge buyback scheme.

Disclaimer: We may be compensated by some of the companies whose products we talk about, but our articles and reviews are always our honest opinions. For more details, you can check out our editorial guidelines and learn about how we use affiliate links.Follow Gizchina.com on Google News for news and updates in the technology sector.

Source/VIA :

GSMarena

Read Also: CIRP: iPhone 16 Demand Surges, Affordable 16e Starts Strong