newsTech

Chip stocks slide as Nvidia & AMD warn of China export-related costs

Efe Udin

April 16, 2025

Technology stocks took a hit on Wednesday as leading chipmakers raised red flags over rising costs and demand uncertainty. This new worry is linked to renewed U.S.-China trade tensions. Nvidia and AMD led the decline, with both companies disclosing major financial impacts from tightened export rules. The broader chipmaking sector followed suit. There have been strong reactions from investors due to the trade restrictions. It may undermine growth across the industry.

U.S.-China trade tensions induce losses

Nvidia discloses $5.5 billion charge

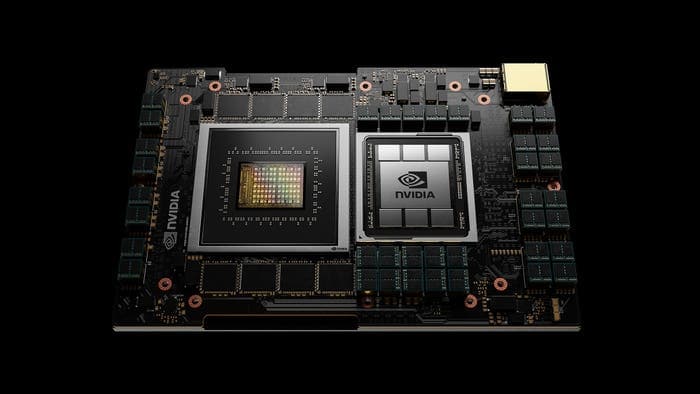

A regulatory filing revealed that Nvidia will take a $5.5 billion charge related to its H20 graphics processing units. These were originally tailored for the Chinese market. After the revelation, Nvidia shares dropped more than 6%. These GPUs had been developed under the Biden administration’s export framework. They comply with the previous ban on advanced AI hardware.

However, Nvidia is now required to obtain licenses to export the chips to China and other designated destinations. This complies with new measures introduced after President Donald Trump’s return to office. The H20 had been expected to contribute up to $15 billion in revenue for 2024. The license requirement and the uncertainty surrounding it have severely altered Nvidia’s near-term outlook.

AMD faces an $800 million risk while ASML misses orders

Advanced Micro Devices (AMD) also warned of major financial exposure. It stated in its filing that new export controls on its MI308 chips could result in an $800 million impact. AMD shares fell more than 6% following the announcement. These statements are the first concrete indications that Trump’s agenda could directly disrupt U.S. chipmakers’ operations and revenue pipelines.

Read Also: NVIDIA RTX 5060 and 5060 TI Go Official With Attractive Price But a Big Catch

Dutch semiconductor equipment giant ASML added to the sector’s woes, missing order expectations and attributing some of the weakness to uncertainty caused by trade restrictions. Its shares declined by roughly 5%, further weighing on sentiment in the chipmaking and tech hardware space.

The U.S.-China trade tension-induced downturn wasn’t limited to chip stocks. The VanEck Semiconductor ETF fell more than 4%, reflecting losses across the sector. Micron, Marvell, and Broadcom each shed around 2%. However, equipment makers like Applied Materials and Lam Research were down roughly 3%. The tech-heavy Nasdaq Composite also slid nearly 2%, with major players like Meta, Alphabet, and Tesla each losing about 2%. Apple, Amazon, and Microsoft posted more modest declines of around 1%. Nevertheless, the pullback shows broader market jitters tied to U.S.-China trade policy.

Disclaimer: We may be compensated by some of the companies whose products we talk about, but our articles and reviews are always our honest opinions. For more details, you can check out our editorial guidelines and learn about how we use affiliate links.Follow Gizchina.com on Google News for news and updates in the technology sector.

Source/VIA :

CNBC