newsXiaomi

Xiaomi Takes Back China’s Top Spot — But for How Long?

Nick Papanikolopoulos

April 27, 2025

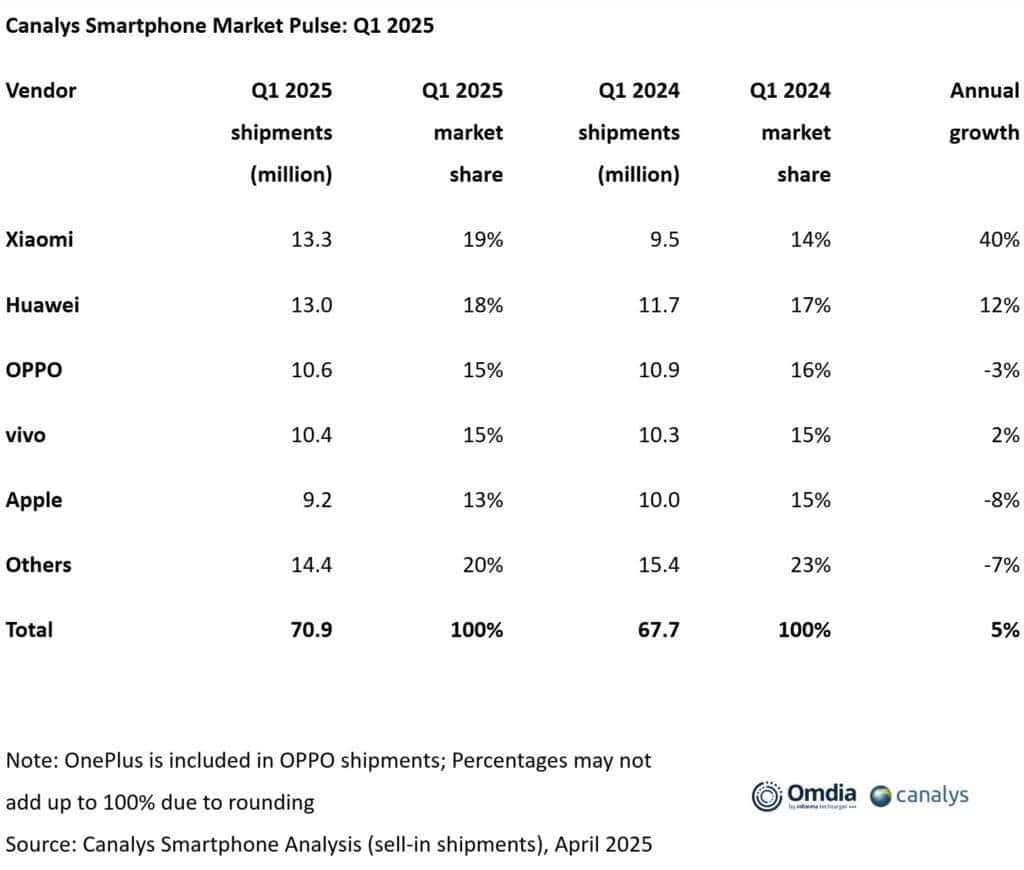

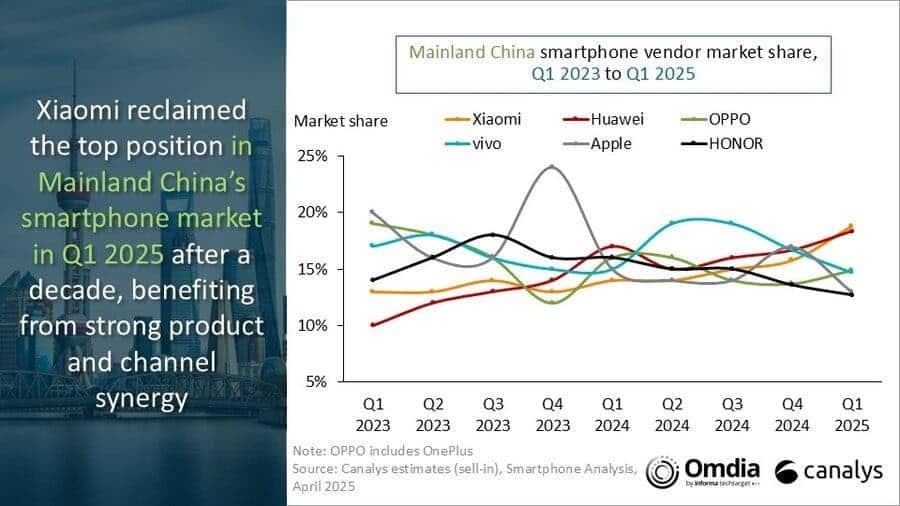

It took a full decade, but Xiaomi is finally back where it once belonged — at the top of China’s smartphone market. According to fresh data from Canalys, Xiaomi claimed a commanding 19% market share in Q1 2025, pulling off a remarkable 40% year-over-year growth. In a landscape as fiercely competitive as China’s, this marks a major shift — and a hard-earned comeback.

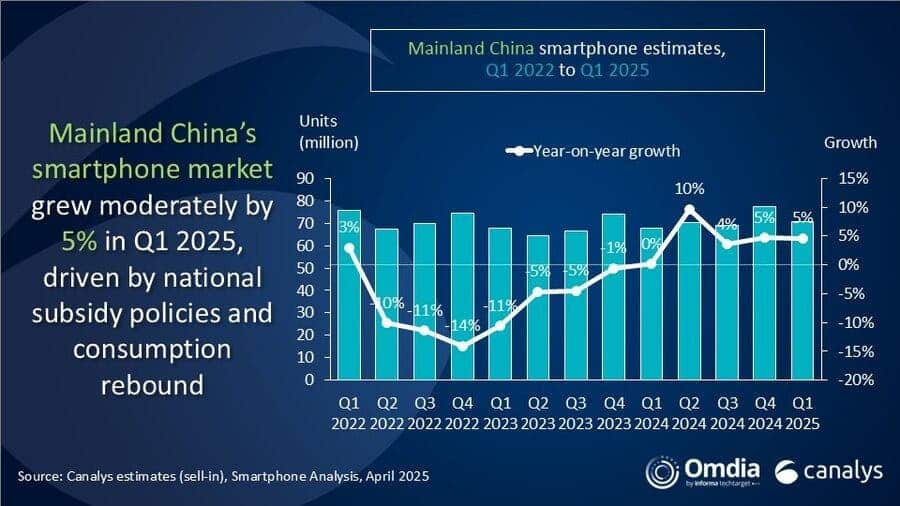

China’s Smartphone Market Is Bouncing Back

The numbers tell a bigger story. In the first three months of 2025, China saw 70.9 million smartphones shipped — a modest 5% jump compared to the same period last year. It might not sound explosive, but it’s the continuation of a recovery trend that kicked off in 2024.

What’s behind the rebound?

- Government subsidies that encouraged consumer spending

- Overall economic recovery fueling buying confidence

- Rising demand for more refined, feature-rich devices

- A strong comeback for physical retail stores after the pandemic slowdown

Consumers are coming back, and they’re coming back smarter — demanding better value, more innovation, and stronger after-sales support.

Who’s Leading the Pack?

Here’s how the top players lined up in Q1 2025:

- Xiaomi: 13.3 million units shipped (19% market share)

- Huawei: 13.0 million units (still showing strong double-digit growth)

- OPPO: 10.6 million units

- vivo: 10.4 million units

- Apple: 9.2 million units (a noticeable 8% drop YoY)

While Xiaomi celebrates its return to number one, Apple’s slide reminds everyone that no position is guaranteed — not even in premium segments.

How Did Xiaomi Pull It Off?

According to Canalys Chief Analyst Zhu Jiatao, Xiaomi’s strategy was a textbook case of smart execution. First, the company adopted a unified pricing strategy across online and offline channels, making life easier for buyers — especially those taking advantage of government incentives.

Second, Xiaomi expanded far beyond smartphones. Its broader product ecosystem played a critical role:

- Wearables (smartwatches, fitness bands)

- Personal computers

- Smart home appliances

- Electric vehicles

Read Also: Huawei Dominates China’s Foldable Phone Market, Says IDC

By tying multiple product categories together, Xiaomi encouraged bundled consumption. A new phone led to a new smartwatch. A new smartwatch led to a smart air purifier. It created a cycle of loyalty — and it worked.

Huawei Isn’t Out of the Race

While Xiaomi is back on top, Huawei isn’t quietly stepping aside. Fueled by consistent double-digit growth, Huawei is pushing aggressively with foldables like the Mate XT and Pura X, and is betting big on the development of HarmonyOS Next — its own in-house operating system. Analysts believe HarmonyOS could carve out a solid 3% of the Chinese smartphone market by the end of the year.

The competition? It’s far from settled. If anything, the battle for China’s smartphone crown just got a lot more interesting.

Disclaimer: We may be compensated by some of the companies whose products we talk about, but our articles and reviews are always our honest opinions. For more details, you can check out our editorial guidelines and learn about how we use affiliate links.Follow Gizchina.com on Google News for news and updates in the technology sector.