Disney+ reported growth of 14.4 million subscribers last quarter, reaching 221 million subscribers across its streaming platforms and placing its figures ahead of Netflix for the first time. Despite launching 12 years after the original streaming service, Disney anticipates growth that will see it overtake Netflix as the default streamer by 2024. In an era of slowing growth, what is Disney doing to achieve success and grow subscriber counts?

The platform’s growth during an economic downturn is impressive, and there are a few notable reasons for its success.

1. Greater untapped market opportunities

One significant factor is the platform’s relative newness. Unlike Netflix, which has already rolled out services worldwide, Disney+ launched in 2019 and is just beginning its global rollout. In 2020 it expanded to demographics including India and Latin America, and it has plans to launch in Vietnam and the Philippines later in 2022. Despite both being streaming giants, Disney has a much larger unaddressed market.

“In essence both companies are at different phases of growth,” Paolo Pescatore, a media and telecoms analyst at PP Foresight, told The Guardian. “Disney is still in startup stealth mode when it comes to direct to consumer services. There are still millions of users to acquire as Disney continues to expand into new markets and rolls out new blockbuster shows.”

2. International expansion vs. slowed US opportunities

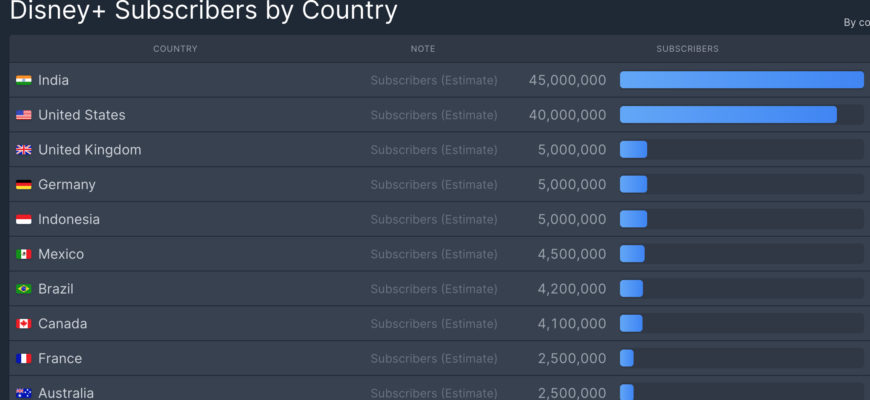

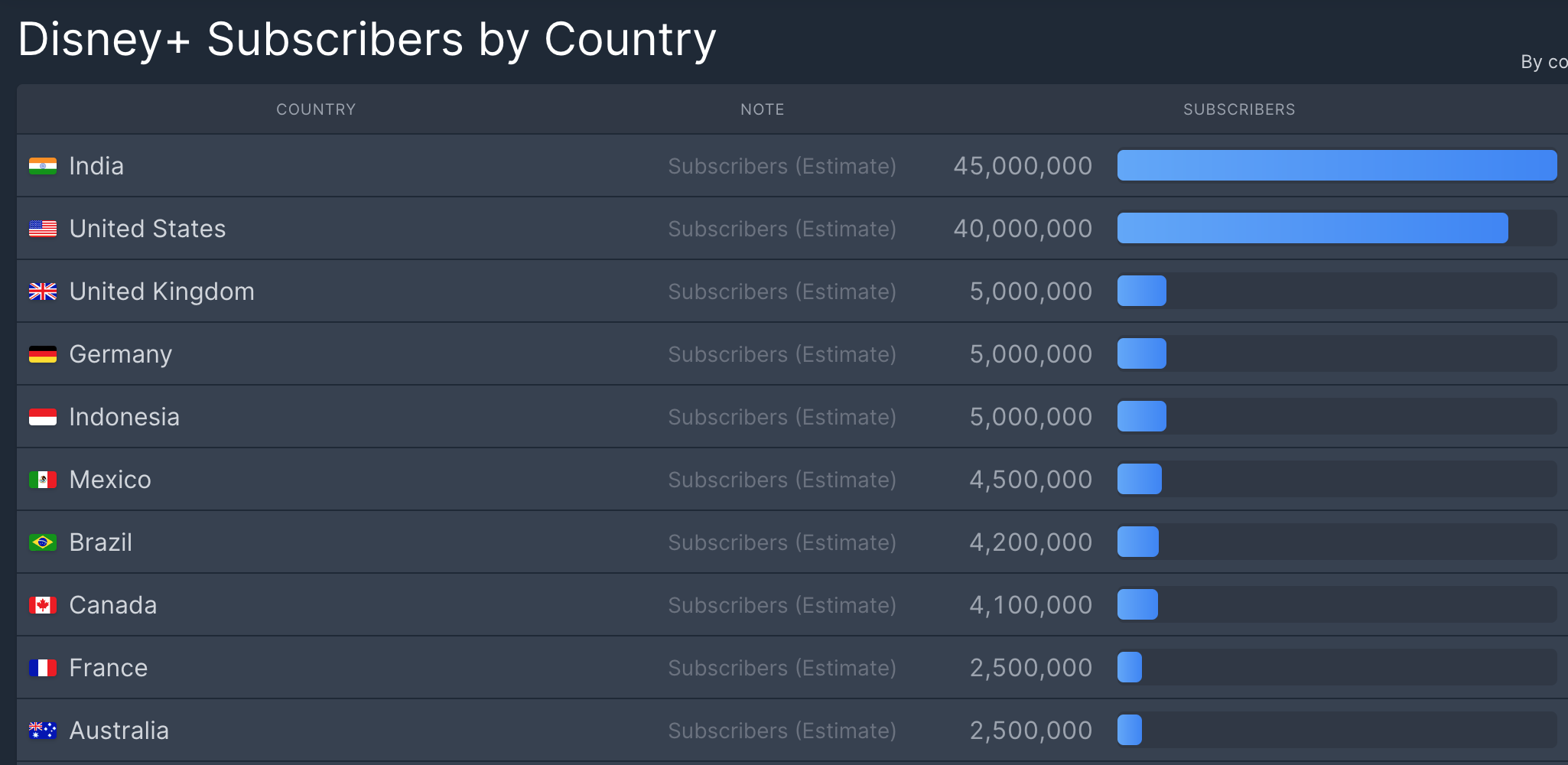

Disney added 14.4 million Disney+ customers last quarter. However, only 100,000 of these subscribers came from North America, where subscriber counts have slowed across all streaming platforms (CBS). In contrast, international markets present healthy opportunities for growth, and the streaming giant is capitalizing on this potential with a strong focus on its global offering.

Top 10 Disney+ Countries by Subscriber Count. Source: FlixPatrol

The importance of engaging international audiences is why localization is a crucial strategy for any media company looking to survive in a competitive market.

3. Savvy acquisitions and range of content

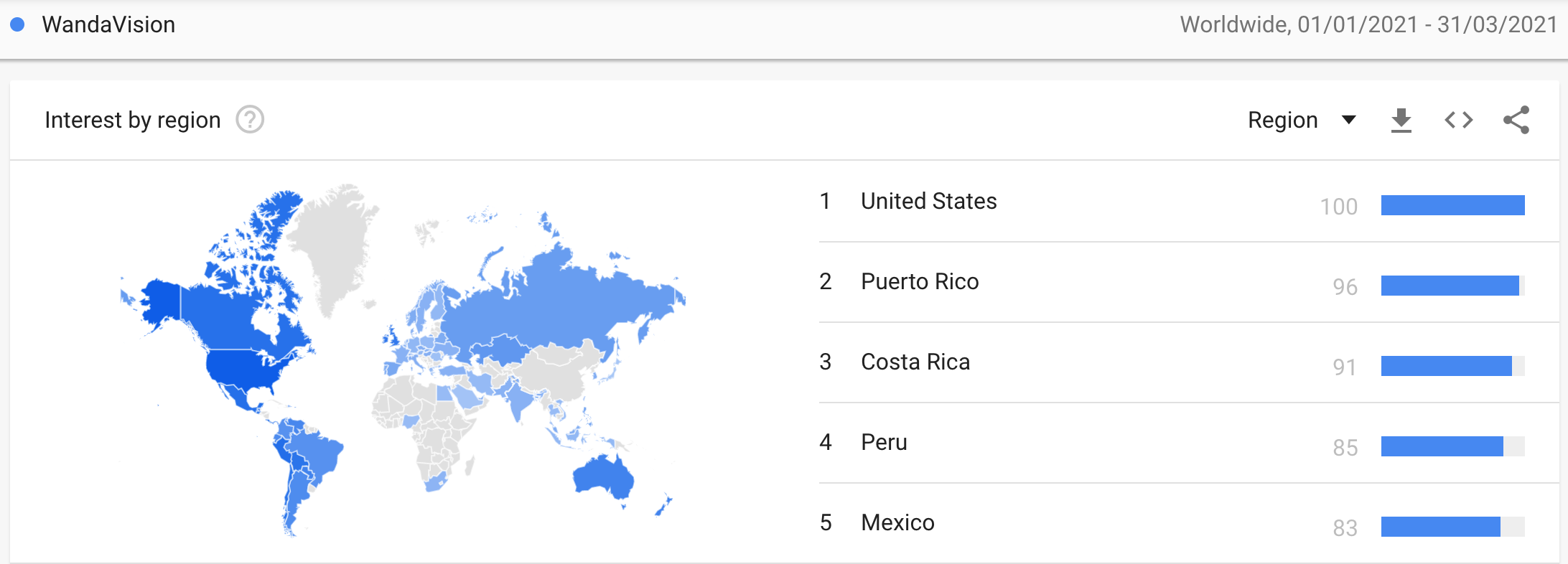

The Disney brand places the streamer in a unique position: with IP and studio rights across several global franchises, the company can release titles attached to hugely popular series, such as The Mandalorian and WandaVision.

Strategically incorporating a wide range of content, such as an impressive international catalog of live sports, has also led to programming that resonates well in local markets. Revenue from initiatives like the Disney theme parks – which have picked up healthily post-pandemic – means Disney has access to budget reserves that allow it to take risks. These circumstances have allowed the company to make bold acquisitions that have placed its content range and quality ahead of the competition.

The comparative success of Disney+ is apparent in its budget. Both Netflix and Disney+ are betting big on long-term success, currently creating significant deficits in acquiring content. However, Disney+ is adding more subscribers and spending less on its programming, compared to Netflix (The Guardian).

A Google Trends graph showing interest in Disney+ TV show WandaVision in the first three months of its release. Four of the top five countries are non-native English speakers, and we can see wide global appeal.

4. A flexible international strategy

Due to its franchising potential and aggressive acquisition strategy, Disney has impressive flexibility in how it chooses to launch its services worldwide. For example, in India, where consumers are unwilling to pay high subscription prices, Disney has implemented a low-cost model where users pay around $1.20 a month. The brand’s acquisition of Fox’s Hotstar and accompanying sports coverage has allowed them to respond to the particularities of the Indian market and made India a stand-out success (the country accounts for 58.4 million of the 152 million global Disney+ subscribers). In contrast, Netflix has famously struggled to succeed in India.

5. Adaptive pricing

With Disney+’s subscriber growth, it’s important to remember the streamer still consistently loses Disney money, with the franchise investing significant amounts to win the streaming land grab. With competition in the streaming industry tighter than ever, investors are keen to see strategies that point to future profitability. It’s therefore unsurprising that the company recently announced plans to follow in Netflix’s footsteps and will introduce an advertising-supported tier and a subscription price hike by the end of the year.

According to Digiday, Disney+ Basic, Disney’s new advertising-supported tier, “will debut on Dec. 8 and cost $7.99 per month”, the current price of a standard advertising-free subscription. To continue with an ad-free viewing experience, subscribers must find the extra money for a new $10.99 monthly subscription fee. While optionality is now a necessity for attracting subscribers amidst the streaming wars, it remains to be seen whether customers will consider the service worth the hike. The introduction of adverts at the existing price tier may lead to viewer churn.

Nevertheless, Disney+ Chief Executive Bob Chapek is optimistic about the move. “We are in a position of strength with record upfront advertising commitment,” he told industry analysts. Disney’s commitment to adaptive pricing suggests a sensitivity to market realities that will encourage the brand’s success.

Compare: Netflix’s ad plans and what good would look like

Summary

Record inflation, cost of living crises, and content fragmentation mean slow subscriber growth will remain a problem for streamers. Despite impressive growth figures, Disney is likely to experience a performance dip as it figures out its advertising model and adjusts to the loss of the Indian Cricket Premier League. However, the flexibility of its strategy, ability to pivot within its varied IP and ventures, and aggressive global rollout mean the company is in an envious position to continue bucking the downward trend.